Alberta’s heavy oil benchmark, Western Canadian Select (WCS), ended the week below US$50 a barrel for the first time since the end of last year. The new 2022 low is blamed in part to lower oil prices in general, but mostly due to a widening of the Canadian heavy oil differential.

OPEC+ RALLY FIZZLES

Oil prices have been steadily falling in the second half of 2022. Prices got a small bump at the beginning of October, after OPEC+ elected to reduce production quotas by 2 million bbl/day. The actual reduction was closer to 1 million bbl/day due to ongoing supply disruptions among key OPEC members.

Signs of a slowing global economy have since erased most of those gains. WTI ended the week at US$76 a barrel, down from over US$120 in June. OPEC now says it sees an oversupplied market in the fourth quarter, and are unlikely to raise quotas at their upcoming December 4th meeting.

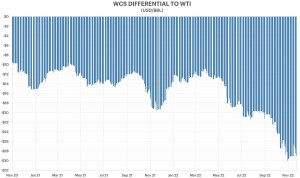

THE WCS DISCOUNT

While all crude benchmarks are down from the highs of early November, WCS has suffered more than most, due to a widening of its discount to WTI.

Oil prices and differentials tend to be the least favourable in winter, when oil demand is the weakest. However, this year’s discounts are the widest since the 2019 curtailment orders, likely due to a return of congestion on the export pipelines.

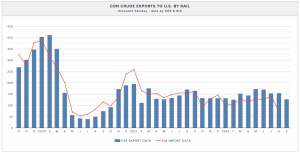

Western Canada’s pipeline network ended 2021 with room to spare, thanks to the completion of Enbridge’s Line 3 Replacement Project in October 2021. TC Energy has since completed a 50,000 bbl/day expansion of its Keystone pipeline which has added additional space. Crude export capacity, excluding refined products, is estimated at about 4.0 million bbl/day.

Although rail transport has lost its lustre, it still accounts for about 125,000 bb/day of crude exports, little changed from last year’s average.

SO WHAT’S CHANGED?

This year proved to be very busy for oil sands operators maintenance-wise, partly due to the deferral of shutdowns during the pandemic. For much of 2022, Enbridge’s Mainline, which transports about two-thirds of Canada’s crude exports, was operating below-capacity due to the drop in supply.

But that trend has since reversed, and production has picked up substantially through the fourth quarter. Bitumen production in particular, which is virtually all exported to the U.S., is expected to exit 2022 at a new record high. Dilbit supply is forecasted to be as much as 300,000 bbl/day higher this December versus the same time last year, when the WCS discount was only US$15 a barrel.

Enbridge now says it’s Mainline will be apportioned in December, which means some producers will be required to look for alternatives. Mainline has a crude export capacity of 3.1 million bbl/day, about 2.3 million bbl/day of which is reserved for heavy oil shippers.

Far fewer maintenance outages are being planned next year, which means 2023 will likely be another record year for the oil sands. The Trans Mountain Expansion Project won’t be put into service until the fourth quarter, which will likely send more of those extra barrels into storage tanks, or onto railcars.

Barring any major disruptions in the oil sands, or a return of curtailment quotas, all roads point to wider discount in 2023.