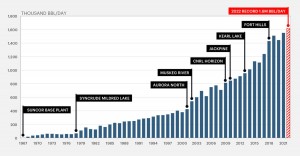

Alberta’s oil sands miners produced a record 1.6 million bbl/day of bitumen in 2022, double the average of 2009. Growth in output has averaged 10% a year over the past two decades, although the past few years have been more volatile due to lack of pipeline space, curtailment orders and the COVID-19 pandemic.

But what does the future hold for oil sands mining? Unlike in-situ facilities, new mines require federal approval, which can be a rather lengthy and uncertain process. Coupled with the looming carbon cap and net-zero aspirations by 2050, it is unlikely any new projects will be submitted for federal approval anytime soon.

However, not all is lost, as there are many expansions and debottlenecking projects that already have approvals in place.

MINE REPLACEMENT PROJECTS

Several existing mines are due to be depleted in the next few years. Both Horizon and Mildred Lake’s North Mine are scheduled to begin winding down operations imminently, and both have approved mine replacement plans already in the works.

Horizon is due to move mining operations to Horizon South, formerly known as the Joslyn North pit, and Mildred Lake will move to Mildred Lake Extension West (MLX-W) in the next few years. Both are strictly a relocation of mining equipment, and will not include any new processing plants.

The next mine to be depleted is Suncor’s Base Plant, which has about 10 years of mine life remaining. Base Mine Extension (BMX) does not have approvals in place, and Suncor recently delayed plans to submit its regulatory application to 2025, which is coincidentally the date of the next federal election. Unlike Horizon South and MLX-West, BMX will require new processing plants, since the mine is located on the West side of the Athabasca River.

DEBOTTLENECKING PROJECS

Horizon has several small projects on the books, including minor reliability enhancements, a new Froth Treatment facility, and an in-pit extraction plant (IPEP). While there is currently no fixed timeline for completion, the three projects have the potential to increase output by almost 100,000 bbl/day.

Imperial’s Kearl Mine also has room to grow within its approved regulatory limit. The company says it is looking at boosting output by 10%, or 25,000 bbl/day, by 2030. In the near term, Kearl is looking at boosting bitumen recovery through the addition of more flotation capacity.

GREENFIELD EXPANSIONS

There are three large expansions that already have federal approvals in place.

Syncrude’s Aurora South was approved as a part of the Aurora Project in the 1990s. Aurora was originally approved for 430,000 bbl/day in four phases — two at Aurora North, and two at Aurora South. Aurora North has an installed capacity of 225,000 bbl/day, leaving “regulatory space” for another 200,000 bbl/day at Aurora South. However, this would require a major expansion of the Mildred Lake upgrader, which is unlikely to happen. The company says Aurora South will be developed once MLX is depleted, which is expected to be about 2040.

Albian Sands also have two undeveloped phases of expansion at Jackpine. The Jackpine Mine was approved for two trains, but only Train 1 was completed. Former operator Shell Canada also obtained approvals for a 100,000 bbl/day production plant at the Jackpine Expansion Mine, which is just north of the existing Jackpine lease.

However, both Albian Sands operating mines have an installed capacity of 340,000 bbl/day, which matches up exactly with the Scotford Upgrader. So any mine expansion would either require an expansion of the upgrader, or the infrastructure to produce a marketable bitumen.

ADDING IT ALL UP

Installed bitumen production capacity among the mine operators is 1.8 million bbl/day, 200,000 bbl/day above last year’s average output. That’s the low-hanging fruit, representing room for improvement that is already approved and in place.

Coupled with expansion plans that are already in the works, mined bitumen production will likely inch closer to 1.9 million bbl/day by 2030.

Canadian Natural Resources has another 200,000 bbl/day of “spare room” at Albian, which could potentially see the light of day much further down the road. However, that would require both relatively robust oil prices, and more clarity on future carbon regulations.